Inflatable Purchase

Save Money on your Inflatable Games

Are you interested in a limited time legal tax haven for your small business? Have you ever heard of Section 179? If you have then you’re ahead of the game; but if you haven’t then you should read this article to save hundreds, if not thousands, on your 2011 tax filings.

Section 179 of the IRS tax code was implemented in 2010 and extended until the end of 2011 through Congressional legislation. Although you’re probably thinking it’s going to be an arcane tax code that only an accounting geek can figure out; it actually is pretty simple. Essentially this section of the IRS code will allow small business to deduct the full purchase price of new equipment. This section is geared to cover tangible property that lasts more than a year. In our case you will be able to deduct the FULL, instead of partial, price of any inflatable bouncer you purchase, from your gross income. When your company purchases equipment normally the government allows for you to only write off the purchase partially to account for depreciation. For example, normally if you purchase $5000 worth of equipment your allowed to depreciate $1000 instead of the full $5000 (these numbers are only serve as an example). But with this limited time incentive you can deduct the full purchase price and save hundreds if not thousands of dollars in taxes.

Section 179 is one of few stimulus incentives that positively influence small business such as inflatable rental companies and indoor family entertainment facilities. Come January 2012 this incentive will expire and revert to only cover depreciation. We strongly encourage you to take advantage of this limited time tax loophole that will save you tons of money in the next few months when you have to file federal and state taxes. To top-off the amazing incentive by the federal government; we also have phenomenal pricing on all our in-stock items that will continue until December the 30th and can be found by visiting our On Sale page.

Unfortunately good things don’t last forever. If you would like to save money in the long run get your orders in by the 30th and we can schedule to send them to you at your connivance. This article is not meant to be tax advice and should only encourage you to speak to your CPA about the benefits of purchasing by year’s end. If you have any questions or would like to talk to someone to place your order please contact you at 800-717-5867 or info@bestjumpers.com.

Calculate Your Savings

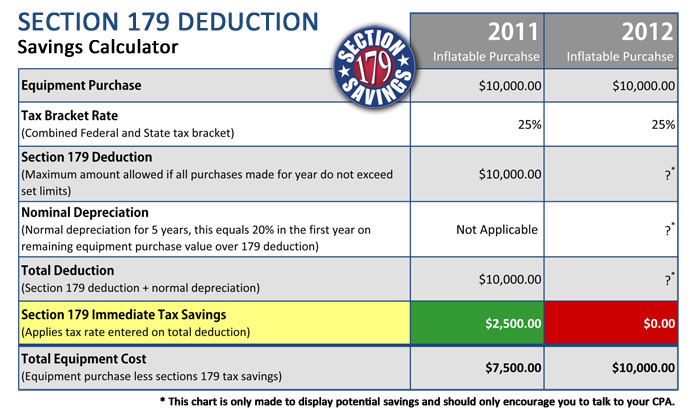

So now you’re probably thinking how much exactly could I save? Well we can help there also. Click here to be directed to a financial calculator that can estimate your savings when you enter a potential purchase total. You also need to indicate your tax bracket which varies on your annual income. Regularly, average middle class families would fall under the 15-28 percentage brackets. Once you enter in the total and indicate the bracket you’ll see the savings you’ll get this year. You will also notice the years are off; because the legislation was extended from last December the dates are old but the taxes you’re going to save will remain constant until December 30, 2011. We hope this was helpful in your decision-making as a business owner and welcome any questions or comments.